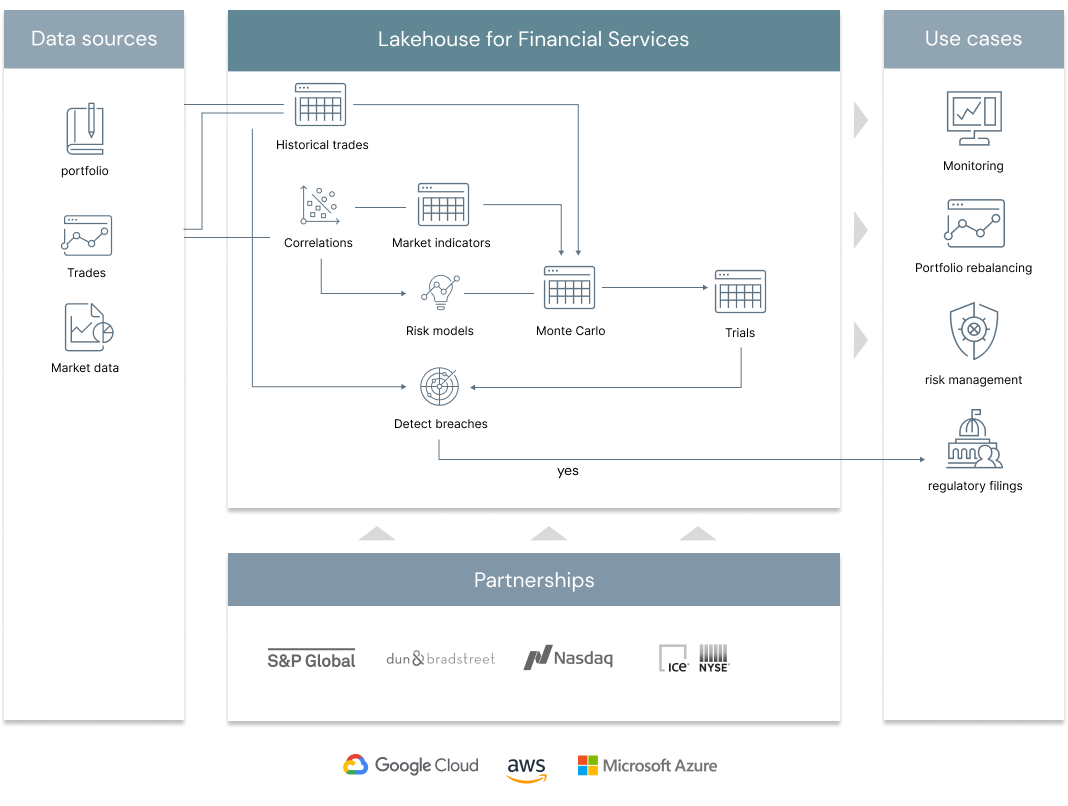

This solution has two parts. First, it shows how Delta Lake and MLflow can be used for value-at-risk calculations – showing how banks can modernize their risk management practices by back-testing, aggregating and scaling simulations by using a unified approach to data analytics with the Lakehouse. Secondly. the solution uses alternative data to move towards a more holistic, agile and forward looking approach to risk management and investments.

© 2022 Databricks, Inc. All rights reserved. The source in this notebook is provided subject to the Databricks License [https://databricks.com/db-license-source]. All included or referenced third party libraries are subject to the licenses set forth below.

| library | description | license | source |

|---|---|---|---|

| Yfinance | Yahoo finance | Apache2 | https://github.com/ranaroussi/yfinance |

| tempo | Timeseries library | Databricks | https://github.com/databrickslabs/tempo |

| PyYAML | Reading Yaml files | MIT | https://github.com/yaml/pyyaml |